|

|

|

|

|

|

|

|

|

|||

|

|

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

||||||

|

||||||

|

||||||

|

||||||

|

|

|

|

|

|

|

|

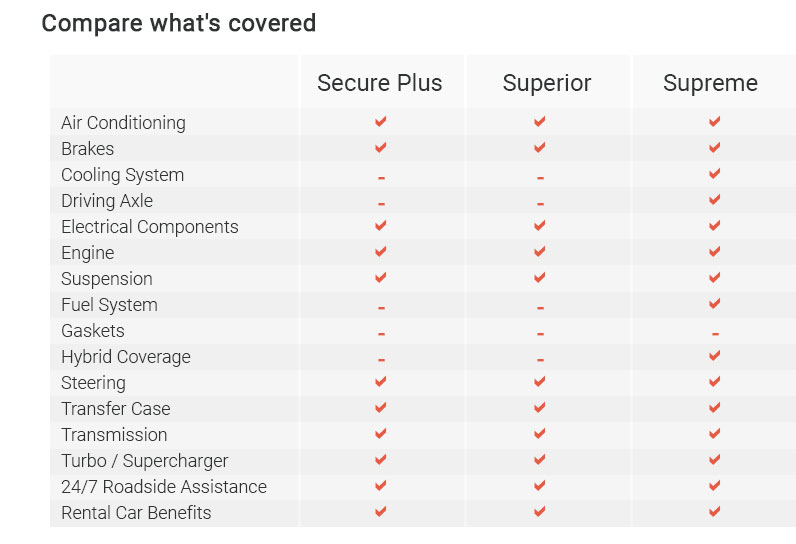

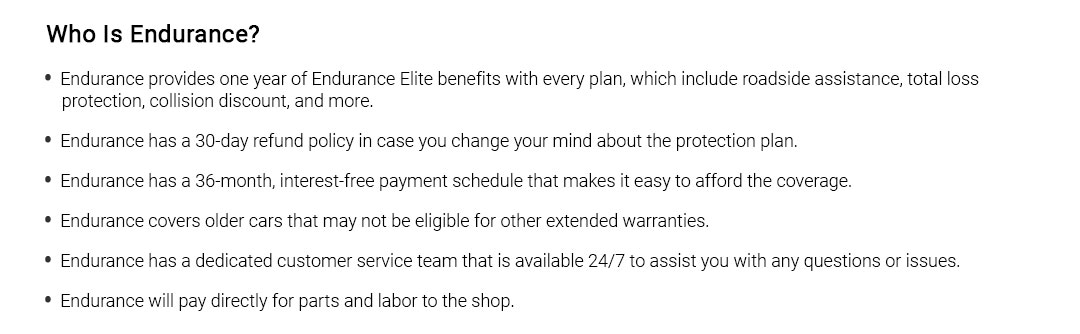

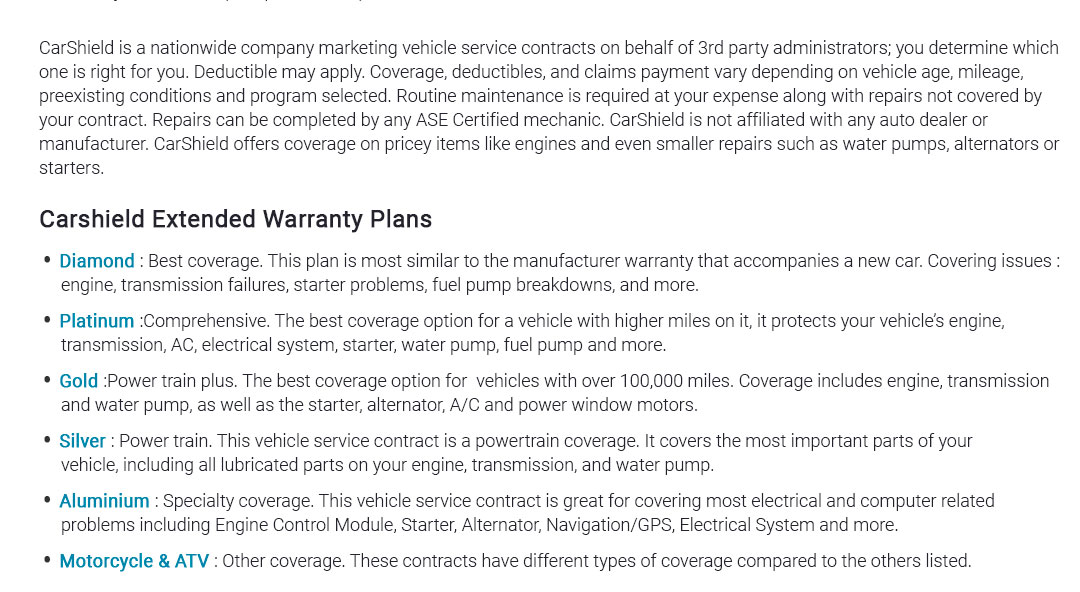

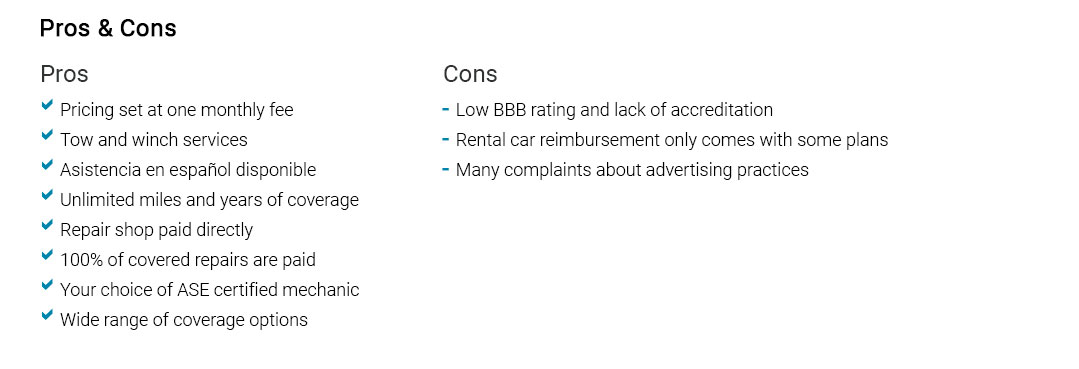

Understanding Auto Repair Insurance Plans: A Comprehensive GuideIn today's rapidly evolving world, where vehicles have become an essential component of daily life, the need for reliable auto repair insurance plans has never been more critical. These plans, often overshadowed by traditional car insurance policies, offer a unique layer of financial protection for vehicle owners. But what exactly are auto repair insurance plans, and how do they function? Auto repair insurance, also referred to as mechanical breakdown insurance, is a type of policy designed to cover the cost of unexpected mechanical failures or breakdowns. Unlike standard auto insurance that covers accidents and liability, repair insurance focuses on the components that keep your vehicle running smoothly. It is akin to an extended warranty, yet it extends beyond the manufacturer's warranty period, providing peace of mind to those wary of unexpected repair bills. The mechanics of how these plans operate can vary significantly depending on the provider. Typically, they cover major components such as the engine, transmission, and electrical systems, with some plans offering more comprehensive coverage options that include ancillary systems like air conditioning and power steering. However, it's crucial to understand that not all plans are created equal. A thorough examination of the policy details is imperative to ensure that the specific needs of your vehicle are met.

In conclusion, auto repair insurance plans offer a valuable safety net for vehicle owners, particularly those with older cars or those who drive frequently. They provide an extra layer of protection that can be indispensable in the face of unexpected mechanical issues. However, like any financial product, they require careful evaluation and a clear understanding of the terms involved. In a world where financial prudence is paramount, having an auto repair insurance plan could be a wise decision, ensuring that you are well-prepared for whatever the road ahead might bring. https://olive.com/coverage-plans/

olive.com plans adhere to strict insurance regulations and are backed by an excellent A+ rated insurance underwriter. So, rest assured that with olive.com ... https://autoleap.com/blog/types-insurance-auto-repair-shops/

There are several reasons to get auto repair shop insurance. It protects your finances against common risks such as theft, lawsuits, and other damage. https://cluballiance.aaa.com/automotive/vehicle-warranty

For all contracts purchased on or after April 4, 2023 please have the repair shop call (844) 878-9431. Cancellation Policy: All cancellation requests may take ...

|